The interbank rate is a term that comes from Oanda’s tool that essentially represents the additional cost that financial institutions (banks, credit cards, and currency exchange kiosks) will charge on top of the real exchange rate. If you end up changing money at a kiosk, this will be much higher (5%). That said, the rate wouldn’t be the most accurate since the above example has the interbank rate set to 3% which is the average for most credit card foreign transaction fees. Normally, you won’t use this side of the cheat sheet much but if you’re in a bind and want to see how much the home currency in your pocket (CAD) can be worth if converted to EUR, this is a general guide. How about the left hand side? This is the exact inverse of what you see on the right side with the interbank rate factored in. Let’s say you want to buy something that’s 500 EUR using a credit card and want to figure out how much it’ll be on your statement, you’ll see that it’s $706.15 CAD. When you’re in a European Union country such as the Netherlands, you’ll look at the right hand side of the chart. The example above is for someone that wants to converts Canadian Dollars to Euros. How exactly should a traveller be using this printable currency converter? There are a lot of numbers on the cheat sheet.

#OANDA COM CURRENCY CONVERTER HOW TO#

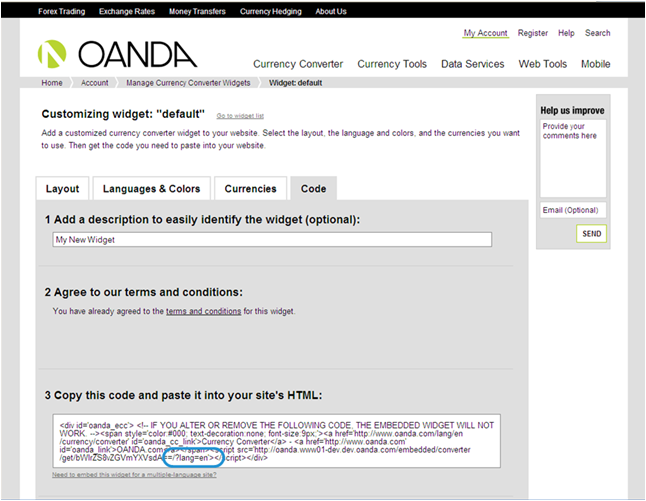

How to read the currency conversion cheat sheet

#OANDA COM CURRENCY CONVERTER UPDATE#

As priorities changed with Oanda and their need to update the user interface forced the platform to evolve, they simply removed it completely at the end of 2021. What started off as a brilliant printable currency converter simply disappeared in the wind. dollars by the bank processing the payment, not the date the foreign currency payment is received by the IRS.The best version of the Oanda Cheat Sheet dollars is based on the date the foreign currency is converted to U.S. tax payments in a foreign currency, the exchange rate used by the IRS to convert the foreign currency into U.S. Note: The exchange rates referenced on this page do not apply when making payments of U.S. Below are government and external resources that provide currency exchange rates. Currency Exchange RatesĪn exchange rate is the rate at which one currency may be converted into another, also called rate of exchange of foreign exchange rate or currency exchange rate. dollars to report on your income tax return. At the end of the year, translate the results, such as income or loss, into U.S. dollar, make all income tax determinations in your functional currency. If your functional currency is not the U.S.

You can generally get exchange rates from banks and U.S. If there is more than one exchange rate, use the one that most properly reflects your income. Use the exchange rate prevailing when you receive, pay, or accrue the item. (including taxes), that you receive, pay, or accrue in a foreign currency and that will affect computation of your income tax. dollar, you must immediately translate into dollars all items of income, expense, etc. Make all income tax determinations in your functional currency. The business books and records are not kept in the currency of the economic environment in which a significant part of the business activities is conducted.

0 kommentar(er)

0 kommentar(er)